2025 Wrapped: A Year of Impact, Growth, and Community Investment

What happens when mission-driven capital meets entrepreneurs, small businesses, and childcare providers? In 2025, our results spoke for themselves.

From nearly $2 million in investment in small businesses to national media recognition and powerful local success stories, Invest PGH's 2025 was all about growth, opportunity, and community impact. Think of this as our Major Music Platform Year-End Wrap-Up: a look at the numbers, stories, and milestones that shaped last year.

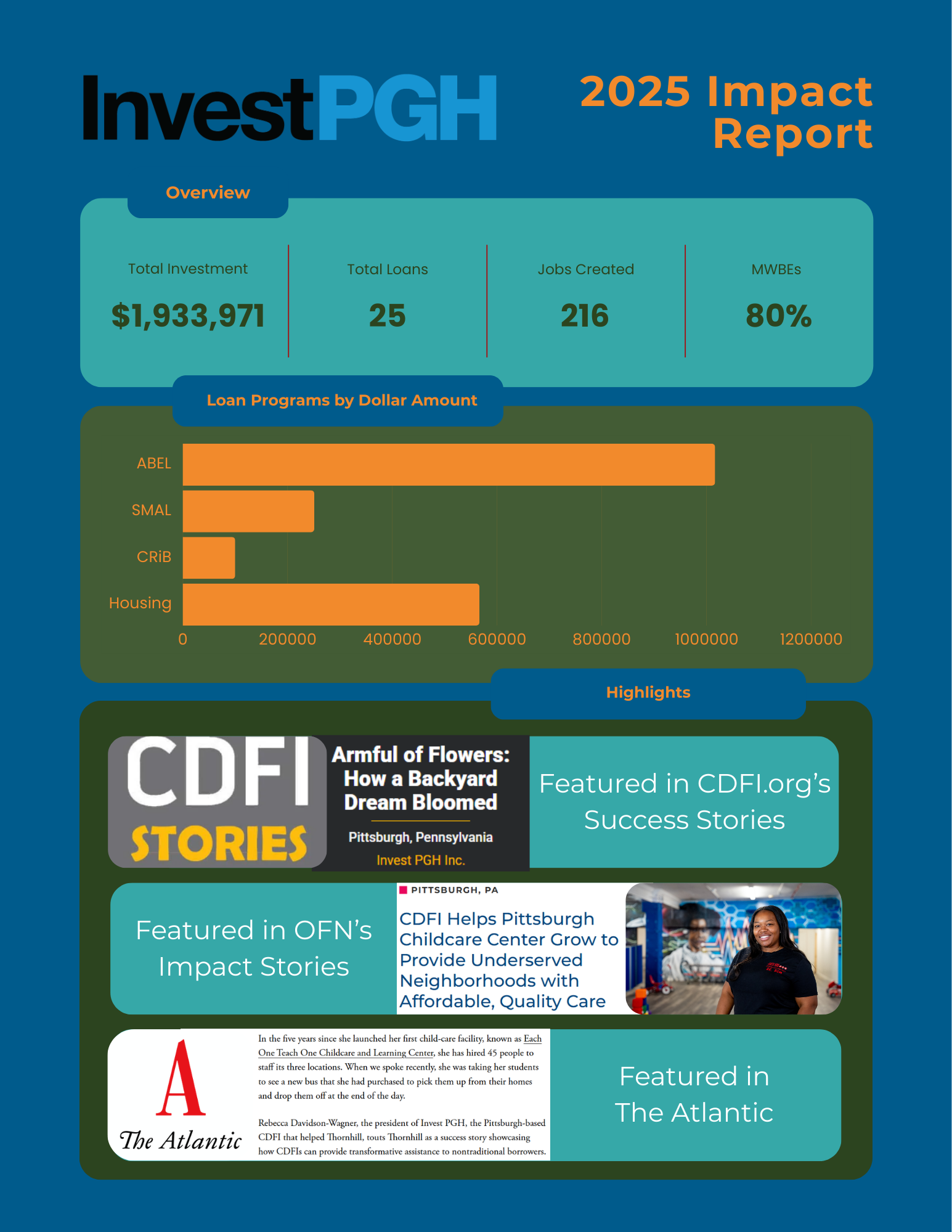

2025 Impact at a Glance:

Total Investment: $1,933,971

Total Loans Closed: 25

Jobs Created: 216

Minority- and Women-Owned Businesses Supported: 80% of borrowers

These investments helped local businesses grow and expand, supported entrepreneurs historically excluded from traditional financing, strengthened main streets, and expanded access to affordable childcare.

Where Investment Went

ABEL Program: $1,016,500 across 10 loans

The Accelerating Business Expansion Loan (ABEL) Program was the largest share of 2025 investment. These loans supported businesses who were ready to scale up their operations, expand their services, and create jobs, providing financing for growth that traditional lenders often cannot offer.

SMAL Program: $251,000 across 10 loans

Small businesses still remain the backbone of local economies. Through our Startup & Mini Advancement Loan (SMAL) Program (formerly Micro), Invest PGH helped entrepreneurs launch their ventures, stabilize their operations, and build long-term financial stability.

CRiB Program: $100,000 across 4 loans

The Childcare Reinvestment Business Fund (CRiB) continued to strengthen Pittsburgh's childcare infrastructure. Childcare is a critical economic driver that supports working families and regional workforce participation. These investments helped providers expand their capacity, improve their facilities, and deliver quality care in underserved communities.

Affordable Housing: $566,471

Something different for us in 2025 was a significant Affordable Housing Program investment, which supported housing stability and neighborhood development.

Equity remains central to our work. 80% of Invest PGH's business lending dollars in 2025 went to minority- and women-owned businesses (MWBEs), which reflects our continued commitment to expanding opportunity and addressing historic barriers to capital access.

Jobs, Growth, and Neighborhood Investment

Beyond big numbers, our portfolio reveals the real-world impact of community lending.

Loans supported businesses across numerous industries, from food service and retail to personal care and childcare services

Lending occurred in neighborhoods where access to capital is historically limited

Lending actively contributed to job creation and business expansion, helping local economies and supporting community vitality

Each loan is more than a transaction: it's a human being taking a leap of faith, a neighborhood gaining a resource, a community growing stronger.

National Recognition and Major Milestones

In 2025, Invest PGH's work gained national attention, showing the growing importance of community development financial institutions (CDFIs) in building and growing equitable local economies.

Featured in The CDFI Coalition’s Pennsylvania Success Stories for Armful of Flowers: How a Backyard Dream Bloomed

Featured in Opportunity Finance Network's (OFN) Impact Stories, highlighting how Invest PGH helped Each One Teach One, a Pittsburgh childcare center, expand and provide affordable, high-quality care

Featured in The Atlantic, where national coverage explored the broader role of community lenders and CDFIs like Invest PGH

This recognition underscores the national relevance of local impact, and the continued importance of community finance in Pittsburgh and cities like it.

Stories That Defined 2025

Throughout the year, Invest PGH shared stories that spotlighted our entrepreneurs, partners, and initiatives shaping Pittsburgh's economic future.

The 2025 Holiday Shopping Guide encouraged Pittsburghers to support neighborhood businesses and shop locally during the holiday season

Our attendance at OFN 2025 strengthened our industry knowledge and collaboration, and put us at the forefront of the evolving role of community finance

A Giving Heart: Open to All highlighted community-centered entrepreneurship

The Dog Penn: Where Happy Hounds Meet Happy Hour spotlighted a unique local business serving dog lovers

Never Mind the Bollocks, Here's the 77 Club showcased creative entrepreneurship and a love of Pittsburgh's neighborhoods

Raise a Toast to the Babes celebrated business growth and community togetherness

Each of these stories illustrates how access to resources and capital contributes to job creation, building community spaces, and making local economies stronger.

Strengthening Critical Programs

A major milestone came early in 2025 when PNC reaffirmed its commitment to Invest PGH's CRiB program through continued funding, ensuring that the program will continue to support childcare providers through 2025. This investment reinforces how essential childcare infrastructure is for a thriving local and regional economy. Invest PGH was also able to supply $253,000 to seven small businesses through our partnership with the PA CDFI Network, with their State Small Business Credit Initiative (SSBCI) funding. We were – and are – also grateful to our Equity Equivalent Investment (EQ2) investors, Citizens Bank and FNB, without whom we would not have been able to be as impactful.

Why This Work Matters

Community lending is about much more than the numbers. It's about offering opportunities to entrepreneurs who have historically faced barriers to traditional financing. It's about supporting working families through access to affordable, quality childcare. It's about strengthening Pittsburgh's many neighborhoods through investment and job creation.

Every one of these loans tells a story: a first storefront, a business expansion, a childcare center being able to serve more families, a community institution finding stability and being able to grow.

Looking Ahead

2025's momentum is carrying us on a wave of continued impact. Invest PGH remains committed to:

Expanding access to capital for underserved entrepreneurs

Supporting minority- and women-owned businesses

Strengthening neighborhood business districts

Investing in working families

Building a more inclusive economy in Pittsburgh

The progress we achieved in 2025 reflects not only our efforts, but the dedication of our borrowers, partners, and community members who share a vision for a stronger Pittsburgh.

Thank you for being a part of this journey, and for helping make 2025 a year of meaningful impact.

Thanks as always to Anna Brewer (right) of Anna Brewer Productions for her beautiful photography and videography.